- Content Link

Home manufacturers trapped within the low-speed money

People exactly who bought otherwise refinanced when interest levels have been off are in fact looking at a large rise in monthly payments when the it to maneuver.

ATLANTA – Eighty-four % out-of people that hope to purchase a house you need to market their present family to make it you are able to. But the majority ones people possibly bought or refinanced whenever desire cost were about 50 % what they’re now. So just why is the fact an issue? Right here to-break that it down is actually FOX 5 A property Professional, John Adams.

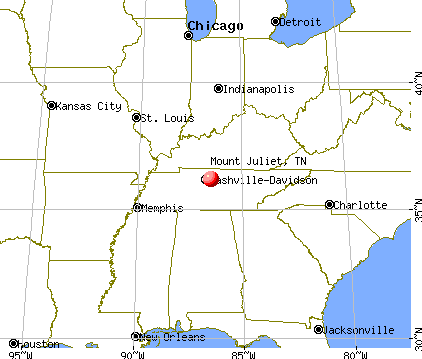

Town Atlanta family suppliers swept up inside their low rate funds

Its existing financial is likely throughout the range of step 3% in order to cuatro%, while it sell https://elitecashadvance.com/payday-loans-ga/cleveland/ one to house, they may be able simply exchange their loan that have one that’s for the the neighborhood away from six.5%, and additionally they just can’t validate the enormous escalation in monthly installments.

Which means you cannot simply offer your house and take the new existing home loan with you to the replacement for family. Once the current house is the fresh collateral into current mortgage, it should be repaid if the possessions offers.

Loan providers be aware that the average Western citizen would like to flow about once all of the eight so you’re able to 9 age, normally. Meaning the lending company tend to assemble his cash from the closure, next turn around and you may lend one exact same cash back in order to good borrower, but this time at the six.5% instead of 3.25%. Bankers aren’t therefore stupid after all.

Which is impacting people and you may sellers not just in region Atlanta, however, all over the world. Residents who need otherwise have to circulate, for reasons uknown, getting caught up because of the their current low interest financing.

That prospective seller informed Adams: « I don’t head paying way too much to own a home inside Atlanta – however, I simply can not take the thought of expenses way too much and achieving to spend double the interest rate. » They just decided to sit lay.

Adams claims uncontrollable government spending along with the brand new rules made to hurt the firm business are the thing that was the cause of disease:

In the COVID-19 pandemic, i invested trillions out of dollars that individuals didn’t have, and handed it out to any or all exactly who said it wished they. We did not have the money, so we released they. As opposed to investing in you to, i set it all for the all of our national charge card. Now we owe nearly $thirty-two trillion, hence triggered inflation.

Jay Powell at Fed chose to put the brake system to the inflation from the elevating interest rates. And you can a couple of weeks ago, the fresh Given elevated prices towards the 10th upright big date, even though financial cost don’t song into federal loans price, they often times move around in a comparable guidance for similar factors.

Although normally home prices do go lower to offset the interest develops, pricing provides stayed stubbornly higher because the the audience is inside the middle of a severe houses scarcity. Inside the town Atlanta, the latest collection is simply below a couple months value of sales. Generally speaking, we believe of half a year out-of inventory since the a state from balance anywhere between a buyers market and you can a vendors markets.

Whenever requested if there’s anything that a possible supplier is do in order to get moved toward 2nd household needed, Adams claims one to – based on their financial activities and their level of comfort – they’re able to remain the current domestic and start to become they toward a beneficial rental. One to saves the main benefit of the low interest rate loan. Because they gather large cost regarding book, that can offset at the least a number of the higher can cost you within this new domestic.

To put it briefly it is important to remember that only the government can cause rising cost of living. And you will rising cost of living, specifically, affects individuals who is also the very least manage it. And even though the present rates have a look higher, he or she is usually just about average. Adam’s information should be to please get what you need, next intend on refinancing when the assuming rates of interest get smaller.

Atlanta local John Adams has been a bona-fide home representative and you will trader into the domestic home for the past five years.

No responses yet